Why is there so much unhealthy sugar in everything we consume? And why has the United States invaded half the countries of the Caribbean? The answer to both is the investments of National City Bank. Charles Philips with an excellent muckrake of the Sugar Trust.

‘The Conspiracy in Sugar’ by J. Ramirez (Charles Phillips) from Voice of Labor (Chicago). Vol. 11 No. 600. May 26, 1923.

If you are a poor wage slave and have been wondering mournfully when the price of sugar is coming down to where Secretary Hoover’s investigating committee says it ought to be, it may comfort you to know that according to dieticians one pound of sugar contains 1,860 heat calories, as compared with 1,110 for roast beef, 1,640 for wheat flour, 685 for eggs, and 325 for whole milk. So although you pay more for sugar than you used to, you can break even by giving up roast beef and eating a little sugar now and then instead. This may strike you as just a rather lame joke, but it is actually suggested in all seriousness by an official of the National City Bank of New York, who has the gall to propose that “an elimination of the less strongly energized foods from the popular diet will solve the whole problem.”

The National City Bank is a sugar bank. The sugar properties owned and controlled by it are so vast that every one cent advance in the price of sugar brings an influx of tens of millions of dollars into its treasury. Naturally, the, officials of such an institution can not find it in them to become alarmed over the high cost of sugar, although it is seldom that one of them shows himself such a boob as the gentleman quoted above. For you and me, a rise in prices has no such pleasant associations.

In January, 1922, Cuban raw sugar was going begging at 1 3/4 cents a pound. Most of this advance has taken place within the last few months; indeed there was a clean 2 cent advance within two or three weeks. Of course you and I don’t get our sugar for 6 3/8 a pound, not by a long sight. First the duty is slapped on, which brings it up to something like 8 1/2 cents; then there is a refiner’s profit, and a wholesaler’s profit and a retailer’s profit, and by the time it reaches our hands the price up to 11 or 12 cents.

A week or two ago prices reached their high mark. Someone get wind of the enormous profits the sugar dealers were piling up and shouted scandal. Then Basil Manly sent bis famous telegram to the Secretary of Commerce, Mr. Hoover countered by appointing an investigating committee, the Hearst newspapers launched out on a series of furious editorials to build up their circulation, and everyone began to talk of speculation in the sugar market. Prices have receded about half a cent since then, and Mr. Manly, Mr. Hoover and Mr. Hearst are all claiming the credit. The indignant brokers and sugar dealers report unanimously that there never was any speculation at all.

Was there speculation, or not? Use your own judgement. In the first four months of this year, when prices were advancing most rapidly, the situation of the United States and of the world in the matter of available stocks of raw sugar was more favorable then at any time within the last three years. The production of cane and beet sugar for 1921-22 was approximately 1,000,000 tons greater than in the preceding year, and the estimated production for 1922-23 was 521,000 tons more than for 1921-22. There was no abnormal demand, and quotations were determined, as always, by fictitious bids in the New York Coffee and Sugar Exchange. About 75 per cent of all transactions are cleared through this exchange. These dealings result in the actual delivery of very little sugar; they represent trading in “futures,” the brokers buying and selling every successive sugar crop many long times over long before it is ripened, although the only sugar that ever does come before their eyes is on the breakfast table in the morning.

“Of course there was some speculation…” the Financial World admits. Modern capitalist industry, with its complex system of stock and commodity markets, is based upon speculation; it is part of everyday business life.

But petty commission agents and sugar brokers did not determine the present price of sugar. When it comes to sugar, even speculation is not honest. Manipulation is a familiar feature of every stock and commodity market in the world, but on the New York Coffee and Sugar Exchange the whole trend of the market is manipulated by the sugar interests. The “speculators” are often nothing but puppets, at least in the sense that they simply react to stimuli adroitly applied from the outside. Among the conservative and revered business men who have added their voices to the general outcry against speculation are Earl D. Babst, president of the American Sugar Refining Co. James H. Post, president of the Cuban-American Sugar Co. and Claus’ A. Spreckels, chairman of the Federal Sugar Refining Co., all important figures in the great Sugar Trust. Yet in spite of the touching solicitude for the public exhibited by these pious hypocrites, the truth is that the recent speculation on the Sugar Exchange was deliberately engineered by the Sugar Trust itself. Neither Daugherty nor Hoover said anything about this, but it is common gossip, in financial circles.

The movement was initiated by the squadron of Rockefeller market operators working in conjunction with Lamborn & Co., which is the most important of the firms, dealing in sugar futures; the professional speculators were soon drawn into the market under the influence of the operations of the big fellows; the mad preamble was on–and of course the Sugar Trust “was obliged to put its prices up as a result of the great speculative demand.”

Notwithstanding the fact that it was “officially” dissolved some years ago, the Sugar Trust is still doing business at the old stand. It is a gigantic machine completely dominating its field, its operations covering every phase of the sugar business: refining and marketing. The Sugar Trust is made up of the powerful oligarchy of the Rockefeller, Havemeyer and Rionda interests doing business through Rockefeller’s National City Bank. Outstanding personalities are Percy Rockefeller, Horace Havemeyer, Charles E. Mitchell, Newcomb Carlton, Earl D. Babst, James H. Post, T.A. Howell and Manuel Rionda. This trust has but one end in view–the piling up of capital. It is an excellent example of the final flowering of capitalism in the United States, in which mighty industrial combinations are built up, not for the rendering of efficient service but for the sake of profits. To gain its selfish purposes it does not scruple to manipulate markets, curtail supply, lay waste to great sugar plantations, throw thousands of tons of sugar in the sea, wage deliberate war against defenseless people in Central America and the islands of the Caribbean, and ruthlessly repress any attempt on the part of the American workers to gain a decent standard of living.

Gigantic Combinations.

The great size of the Sugar Trust will be appreciated when it is remarked that it has nearly $1,000,000,000 invested in the sugar industry of Cuba alone; the various phases of the sugar business in this country represent an additional $1,000,000,000 investment, while interests in in Porto Rico, Hawaii and the Philippines are valued at $240,000,000.

The chief operating concern of the Sugar Trust in this country is the American Sugar Refining Co., which handles a quarter of the sugar consumption of the United States. This company is capitalized at $90,000,000. Its operating profits last year, after payment of all charges, including taxes, was $10,088,832; this is inclusive of the dividend return from its investments. As the basic unit of the Sugar Trust in this country, it effectively controls its industry. Sugar tariffs mean nothing to it, for other than to further fortify it against foreign competition, although it imports a large quantity of its raw sugar from Cuba the 20 per cent differential in favor of Cuban imports gives it a decided advantage as compared with European companies. Incidentally, producing costs in Cuba are the cheapest in the world, due to the terrible exploitation of native labor. As far as the much talked of competition from the American beet sugar producers is concerned, that is all nonsense. The most important beet sugar concern in the United States is the Great Western Sugar Co., and the American Sugar Refining Co. owns 145,982 shares of its common stock and 48,200 of its preferred stock. In six months’ time the investment in Great Western $3,600,000. American Sugar Refining also owns 34 per cent of the capital stock of the Michigan Sugar Co., 50 per cent of the stock of the Spreckels Sugar Co. and 100 per cent of the stock of the Waverly Sugar Co. The Continental Sugar Co. is owned jointly by Horace Havemeyer and associated interests So much for the beet sugar producers. The larger “independent” refiners, such as Warner, Federal, Arbuckle, etc., are also in great measure controlled by the Sagar Trust.

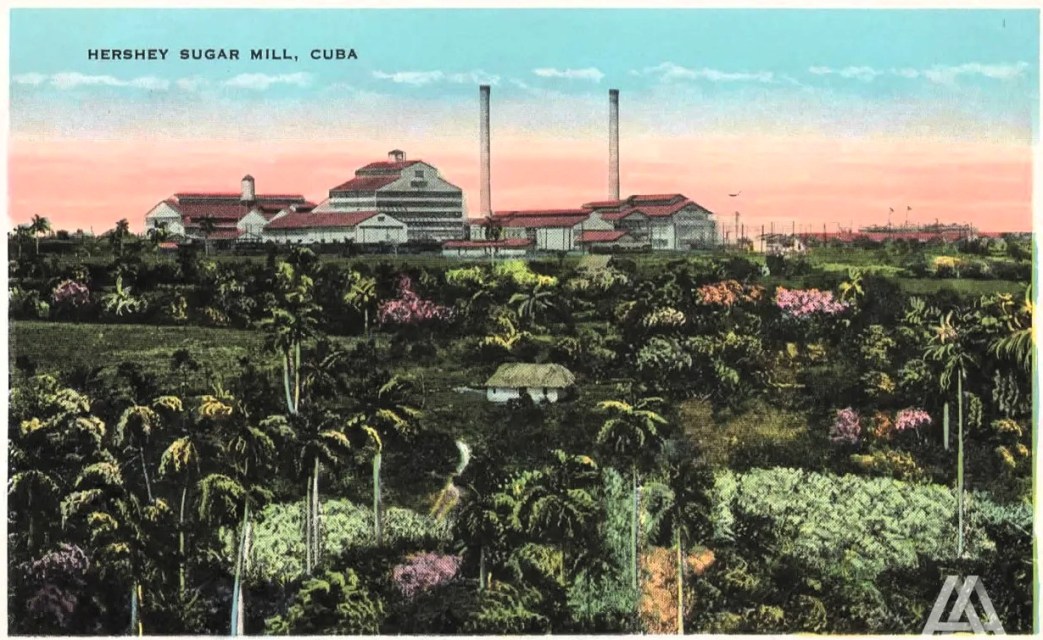

American Sugar Refining and affiliated companies buy their raw sugar from cane and beet sugar companies in the United States, Latin America and the Philippines, most of which are owned by the Sugar Trust. The trust controls practically every important sugar company in Cuba, where it owns millions of acres of the best cane land in the world.

Widespread Influence.

All the loose ends of sugar financing are gathered up by the National City Bank. The influence of this institution, which has deposits totaling $756,747,018 and is the most powerful in the United States, is felt throughout the sugar industry. Eight of its directors are presidents of sugar companies and the bank itself has large sugar properties, especially in Latin America, where it has its hand in a score of dark political intrigues. Besides those companies directly owned, many more are under mortgage to it and are obliged to accept its control. No less than 50 Cuban sugar companies are in this position.

When the National City makes a lean it is stipulated that the bank shall have a voice in the management.

Often the bank makes loans knowing that they can never be repaid–the purpose being to get possession of the mortgaged property when interest goes into default. In this way it has created quite a Latin-American empire for itself. Besides its sugar properties, the National City Bank has important banking and other interests throughout Central America, Columbia, Cuba and the Caribbean islands, where it has made and un-made governments, fomented bribery and disruption, looted systematically. Government and Trust.

In all its adventures it has been able to count on the unqualified support of the United States Government, that two-faced monster, ever ready to do the bidding of the big capitalists. Thus American marines have subjugated Haiti and Santo Domingo to protect the bank’s ill-gotten gains, just as American soldiers invaded the little republic of Costa Rica to obtain concessions for it at the point of the bayonet. In many parts of Latin America the United States army and navy, as well as the entire diplomatic service, are looked upon as simple agencies of the National City Bank.

It is not only foreign fields that the American governmental machine in up with the Sugar Trust. Right here at home of our government gives daily evidence of its affection for the sugar interests. For instance, only a few weeks ago Congress passed a special law turning over $4,000,000 of government money to B.M. Howell, Son & Co., the American Trading Co. and Philip De Ronde & Co., “the money to be paid out of the funds of the Sugar Equalization Board, to reimburse these firms for losses sustained in importing Argentine sugar in 1920.” As you might suppose, all of these concerns are linked up with the Sugar Trust. The Howell firm has a representative on the board of directors of the National City Bank, and two of its partners, James H. Post and T.A. Howell, are leading figures in a dozen Sugar Trust subsidiaries.

Deserves Our Admiration.

One can scarcely refrain from admiring a combination that can get away with as much as the Sugar Trust has done. When we think of all that it has done to us in the past and all that it will do to us in the future, the market flurry in connection with the recent advance in sugar prices seems almost insignificant.

The Voice of Labor was a regional paper published in Chicago by the Workers (Communist) Party as the “The American Labor Educational Society” (with false printing and volume information to get around censorship laws of the time) and was focused on building the nascent Farmer-Labor Party while fighting for leadership with the Chicago Federation of Labor. It was produced mostly as a weekly in 1923-1924 and contains enormous detail on the activity of the Party in the city of those years.

PDF of full issue: https://www.marxists.org/history/usa/pubs/vol/v11n600-may-26-1923-VOL.pdf